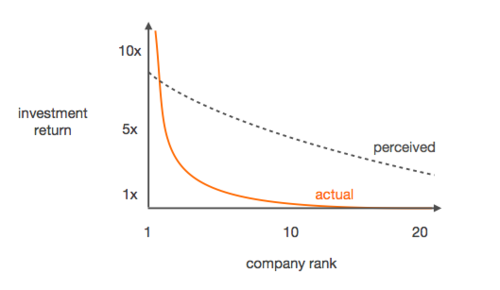

I recently re-read three fantastic (and imo canonical) older crypto posts that shaped a lot of how people think about value capture in crypto (Fat Protocols, Thin Applications, and Crypto Tokens and the Coming Age of Protocol Innovation). via Power Laws & Normal Distribution in Crypto The original fat protocol thesis is well understood in terms of L1 value accrual, but it also meant that you...

Recent Comments