In technology, the concept and cycles of bundling and unbundling are well-understood. Historically what we have seen is that at very early stages, unbundling occurs, until some early primitives and use-cases are understood, which then results in bundling often due to necessity to level set a user experience or to kickstart true usage. As a given platform matures, unbundling then occurs to optimize for higher value products to be created that can materially expand TAM or user base broadly.

In 2019, Multicoin walked through the unbundling of the Ethereum ecosystem making a compelling case for L1s.1it is my belief that since then crypto has continually been unbundled on the application layer, while remaining “bundled” in some form at the compute layer (L1s). We have started to see a form of unbundling in ecosystems with EVM compatible side-chains (Polygon and Fantom most notably) as well as L2s (disclosure: Compound is an investor in Arbitrum). Within Decentralized Finance (DeFi) my view is we have seen widely unbundled dynamics as the primitives are still nascent/non-consensus and projects are trying to understand how to navigate the game theorying of incentive mechanisms, build vs. integrate decisions, and broader financial appetite as we move to a smart contract driven world with relatively low institutional participation thus far.

Composability today plays a large role in this, which allows for a very rapid pace of innovation as the top builders stare at a blue ocean of opportunity. This leads to dynamics where core developers work on multiple projects that are holistically aligned in some ways, but perhaps not directly complimentary to their other/prior projects.

What we are starting to see however is the emergence of stacks of the DeFi ecosystem that has created dependencies that in the short-term are malleable due to the aforementioned composability, but in the long-term, likely could have greater switching costs, and consequences, than many appreciate.

Dependencies, Switching Costs, and Strategically Aligning Incentives

In traditional technology we have seen similar dependency dynamics play out when large platforms end up providing value because of their distribution or where companies become overly concentrated on where they derive value because of a high-growth, strong product-market fit customer.

Zynga’s utilization of Facebook as a platform to build easily distributed games is a version of the former, while things like Uber’s explosive growth contributing to Twilio revenue, or Bytedance’s concentration of revenue for Fastly are examples of the latter.

In Web2 we have increasingly seen strategic investments go from company A to company B in order to align incentives in some form2This is debatable if these incentives actually do align, as we recently saw with Stripe launching a competitor to Fast, one of their investments. These strategies are double opt-in and often result in minority ownership in order to remove material conflicts with external customers, however in some cases they are not absent of this. In certain situations, these minority investments become so strategic that the incumbent acquires a majority stake (Intel and Cloudera is a historical example of this). These acquisitions are very hit or miss as hopeful synergies are often overly optimistic and don’t take into account the qualitative aspects of acquisitions.

Within DeFi we have seen more strategic alignment, perhaps with less diligence, due to the aforementioned composability, creating more existential risk than understood. There is material opportunity to think more strategically through these adjacencies that are emerging in order to control for some of these dependency or synergistic dynamics.

An example:

Curve is a platform that works for low slippage, high volume transactions of stablecoins (and now other tokens). Some could compare Curve to the future of ForEx, while others would give it far greater ambitions across a variety of assets. In order to facilitate their low slippage they created a strong liquidity rewards program and paired it with an incentive mechanism that requires people to lock CRV tokens for veCRV, which acts as both a governance token as well as a yield multiplier for providing liquidity.3The CRV to veCRV locking mechanism, which creates long-term alignment and allows for greater voting power the longer you lock your tokens, is in my opinion, one of the best token designs that exists today.

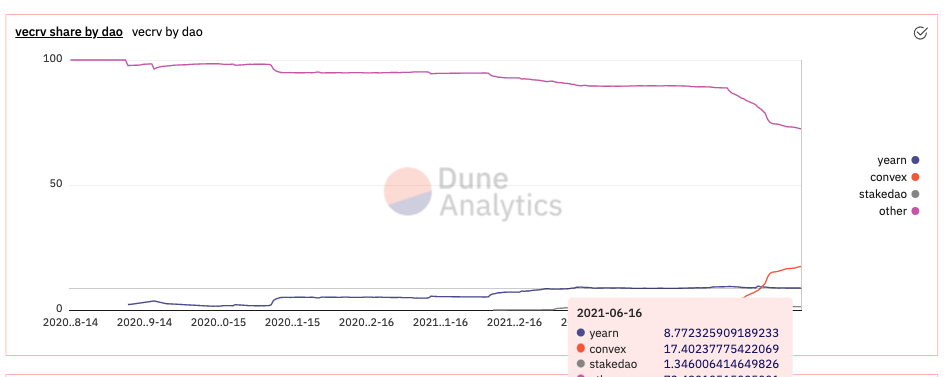

Yearn, most simply, is an asset manager that uses strategists to seek the best yield for given assets in DeFi. They have recognized that veCRV yield multiplication is a compounding advantage with true economies of scale in this regard, and thus often utilize this to out-execute competitors. Because of this, Yearn holds ~8% of all locked CRV.

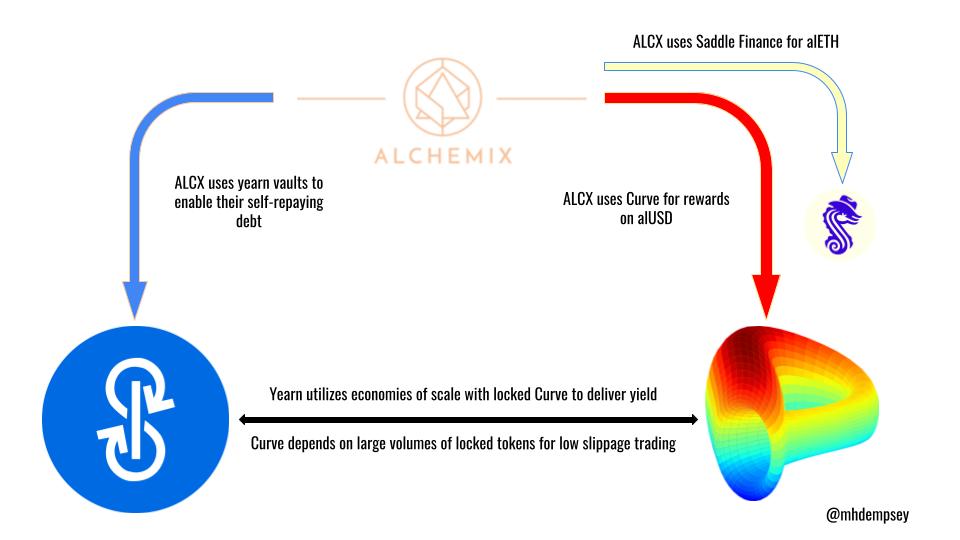

Alchemix is a DeFi project for self-paying loans built on Yearn, using their DAI pool to generate yield that repays a user’s loan. Alchemix attributes a 52% increase of their revenue to the Yearn partnership platform (the beginning of Yearn expanding distribution of their vaults).

All of these projects (and many others) move up and down the stack in terms of dependencies and value creation for each other. They are adjacent projects for the time being with fairly low switching costs (Scoopy Trooples at Alchemix has publicly stated they will happily switch to other strategies with higher yield if need be) however on a long-term time horizon, it is my belief that product/economic moat’s like Yearns could continue to widen (this has been debatably challenged by Convex on one vector recently), and it feels even more likely that community-driven moats could also create a higher barrier for switching4A post for another day.

In short, Alchemix depends on Yearn, Yearn derives some value from usage on Alchemix, Curve’s token benefits from Yearn and Convex locking in a large % of supply to counteract a high inflation rate, and Yearn and Convex rely at least partially on Curve in order to deliver industry leading returns. Dependencies, synergies, existential threats, all lie within the adjacent positioning within this ecosystem.

How to lose friends but influence DeFi

As we continue to progress from the nascency that was DeFi Summer and this open world of finance becomes more mature, it is likely that projects must take a deeper look at understanding their dependencies, strategic positioning within the broader industry landscape, and project forward the roadmaps and scopes of ambition of their adjacent competition in addition to their first-party scopes of ambition.5There is a counter-argument to be made here that in its current state, the economically dominant thing to do has been to launch more tokens and more projects, instead of trying to build on value of an existing token, thus limiting scopes of ambition. This may be true today, but will likely compress over time as power law dynamics take hold within crypto economies.

A lot of this will then result in a more sophisticated take on treasury management. As more projects continue to amass very large treasuries, often in their own token, there must be more explicit strategies deployed both to manage a volatile macro environment (The Llama team is working on this) and perhaps equally as importantly, the strategic initiatives.

Unlike with traditional strategic investments, there is nothing thus far from stopping a project with strong distribution mechanisms, economies of scale, or moats broadly, to continue to diversify their treasury by buying the governance tokens of adjacent projects in order to influence the further direction of their competitors.6Correlation between these assets today could prevent this, but in a mature markets, tokens should decouple

The Yearn team has been smart to do this at a small scale thus far, swapping tokens with projects such as SUSHI, CREAM, Pickle, Cover, and more in an effort to better align their ecosystem.

The role of a strategist that understands the correlation between various assets (something that should shift as crypto projects begin to uncouple as the industry matures), paired with the ever-changing roadmaps should be considered tables stakes moving forward. This is something the best teams, communities, or something in-between will execute on at an order of magnitude higher level than those that just look for simplistic diversification. The ramifications and long-term value that can accrue for groups known for the deepest understanding of adjacencies as well as financial management of treasuries and governance tokens, will be not only downside protection, but also upside creation as centralization of power continues within DeFi.

As I’ve been editing this piece, we have seen a version of this break out in real-time, coincidentally, between the three aforementioned players above as Curve put forward governance proposals that would have negative ramifications for the Alchemix team (full explainer here). This has led to everything from accusations of tyranny within Yearn from others + a core dev of Curve, to perhaps the most relevant speculation of all which is that this has been done as retaliation for the Alchemix team for choosing Saddle Finance (a fork of Curve, and a competitor) over Curve for alETH, a potential signal of Alchemix understanding dependencies, and Curve utilizing its scale to attempt to disadvantage a new product launch7For the record, I don’t know if this is the case, though in some future, it will be.

This is all perhaps a bit complex, so to tie this back to a prior primitive (which I’m sure crypto-natives will hate), when Bytedance informed Fastly it was switching providers, Fastly’s revenue as well as stock price were hurt in the short-term, erasing billions of enterprise value. In crypto, a form of this could have been a Bytedance governance vote, that Fastly would have hopefully been strategic in acquiring governance tokens for a customer that represented double digit percentages of revenue, to campaign against.

But in this scenario, a Fastly can’t possibly have enough money to own enough governance tokens first-hand to out-vote Bytedance core devs, right?

Accumulating Power: Authoritarian or Democratic Regimes in Crypto

As projects begin to think about adjacent governance in a more strategic way, there are a few natural next order effects that could emerge.

Governance Payment/Tolls: As DeFi power becomes more clear within a given vertical, use-case, or asset type, we could see governance payment in order to integrate on top of other protocols just as we see with the App Store’s highly contested 30% take rate on all transactions.

If you want to build on Yearn, do you have to allocate 1-3% of your tokens to the Yearn treasury in order to get priority? This isn’t necessarily a fair launch nor in spirit of decentralization per se, but markets often aren’t fair over long periods of time and as compounding advantages begin to occur, the most powerful projects will game theory decisions like this, at risk perhaps of being forked.

Vote Renting and On-Chain Politicians: The rise of governance renting and on-chain politicians will become increasingly prevalent as governance tokens go from meme to strategic.

Taking a step back, there are some issues with most governance today:

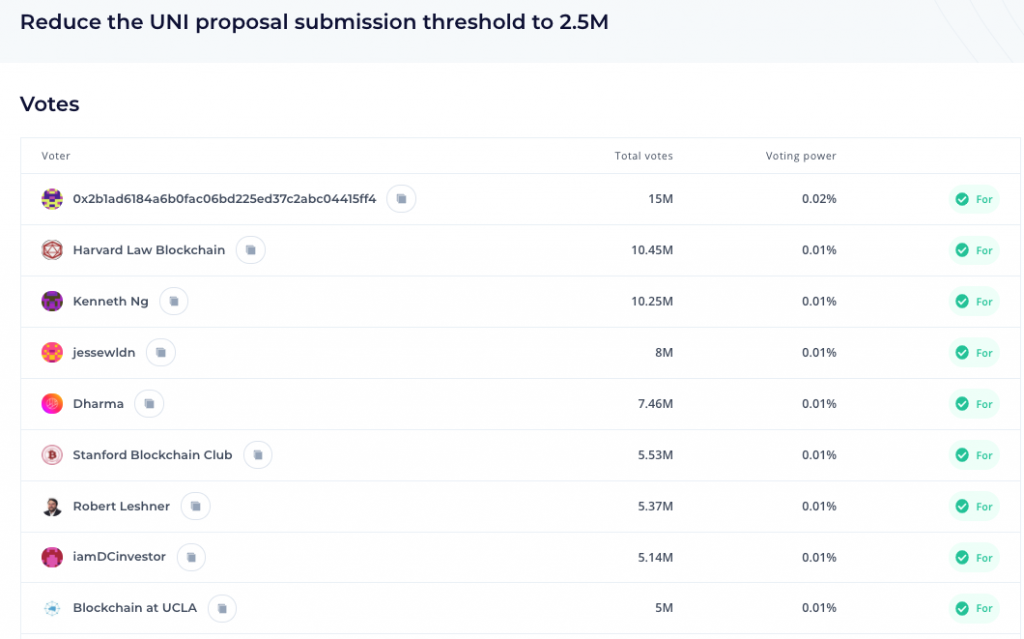

The most obvious is that there is a clear power law of ownership that leads to whales largely accumulating voting power and being able to swing governance votes. One can repeatedly see this, but a recent example is with StakeDAO which had a proposal swung entirely by a single address.

Today whales are most often wealthy project founders, early founding team developers, or investors of some sort of which have varying level of degrees of sophistication and care of participating in governance.

Tomorrow these whales likely could be even more strategic holders, perhaps best embodied today by wealthy crypto founders, various types of DAOs, or more tradfi crypto asset managers. This leads to a disincentive and feeling of helplessness within given projects’ communities as it will make individuals’ votes seem worthless. “Retail” can not fight back against “The Street” (sound familiar?).

John Palmer recently made a point to try to at least lower the barrier for making a governance proposal on Uniswap (it passed). This is in nature a good start, however this core problem was not really solved as we saw when Jesse Walden (a Uniswap Investor with 8M votes) and Robert Leshner (founder of Compound, a portfolio investment of…Compound, and UNI holder with 5.37M votes, representing a small number of delegates) pushed the proposal over the line. In the end, the top 5 addresses that voted to bring the vote forward were enough to pass the 45M limit.

As crypto communities mature, the hope is that these small number of delegated votes will continue to expand in order to present a form of democracy (or at least the illusion of it). But similar to today, people need leaders to follow.

Because of this, just as large hedge funds have historically been able to swing markets relative to retail, eventually retail must band together around a schelling point. The internet’s maturation has lowered those barriers for retail at the coordination layer (Reddit/Discord + WallStreetBets) as well as the execution/capital layer (Robinhood forcing brokers to go low/no-fee on transactions) allowing for an aggregation of small numbers, or the proverbial death by a thousand cuts.

The DeepFuckingValue or RoaringKitty’s of the world will be on-chain politicians that make an attempt to gather delegated votes on behalf of “the people” in an effort to fight for their cause, either for or against centralized power in the mid-term of these projects.

And with this in mind, why would you not then, as a treasury strategist, begin to recruit and compensate the best on-chain politicians for your adjacent governance strategies?

In the physical world, politicians are groomed to accumulate social capital, which they turn into financial capital for campaigning, which they then turn into power. Why would this not hold true in an on-chain world?

The questions to ask as we move towards more politicized primitives of governance are twofold.

First, will the primitives of extremism and most common denominator carry over to the world of on-chain politicians? Put more simply, will there be a political “party” and groups that emerge that represent a core belief system, and then believers fall under a wide-ranging umbrella, just as the left and the right do today in the United States? Those more familiar with global politics likely can hypothesize on this better than I.

Second – Will politicians be as horizontal as they are today (a politician for all of DeFi that centralizes and then delegates power) or will they be much more specific to each given project?

It is my belief that in the near-term, we likely will see more forms of cementing closer-knit, concentrated governance power with the illusion of democracy because of the ease of doing so. The argument often being that these core members of a project have and will know best, and in the fast moving world of DeFi (and really crypto broadly), it will be deemed necessary to the survival of these projects over time. The debate that the world enters over the next few decades of whether authoritarian regimes are actually optimal in a global landscape, or if democracy will survive, will likely be waged in a similar way on-chain, with strong proponents on each side.

Responsible DAOs with a core team that claim to truly want what’s best for the project and not just themselves should make it a point to begin to define what metrics of success and failure look like, as well as what milestones the members can hold them to, just as we do today at the board level of companies and at quarterly shareholder meetings. Without this type of structure, it is likely that because of a macro rise in crypto, the pseudonymity, or the high velocity of members moving between projects, we could see little long-term accountability built up, and thus even more opaque understanding of good and bad actors, and successful and unsuccessful leaders, contributors, and communities.

Capital as Influence – Renting Votes and Short-Term Activism

The alternate path for projects hoping to influence their adjacencies is one that is tried and true: Using capital to solve a problem.

As governance votes become more valuable via point in time proposals, we will see large financial incentives applied via “rented” votes (or perhaps as John Palmer hypothesizes, Farmed votes). Back to the Fastly/Bytedance example, perhaps if you are either Fastly, or their main competitor, you would be more than willing to pay a certain amount to get others to delegate votes to you for a short period of time, in order to swing a platform shift for a core customer or to directly harm a competitor. As a firm, we have experienced this directly at Compound with others pinging us to rent our tokens surrounding important proposals and have opted out of participating in this, despite very high ROI.

I think this is a particularly difficult problem to solve for. Projects could attempt to put counter-measures in place such as blacklisting addresses that are caught doing this (this perhaps goes against the spirit of open platforms) as well as slashing the voting power of recently transferred tokens8This ultimately would likely just put a higher cost burden on those looking to rent though as they would pay more for longer hold duration.

Maturation, Centralization, and Adjacent Governance

With crypto broadly and DeFi specifically quickly moving through the early maturation phases, I believe we will start to see further expanding scopes of ambition to come with further expanding users, assets, TVL, and revenue. There is a world where the composability remains intact when porting over many of the core primitives of traditional finance to DeFi, however it feels more likely to me that services that have largely lived under singular institutions like Wall Street investment banks will increasingly become centralized into powerful entities that understand how to quickly accrue value, create early moats, and most importantly, manage their positioning and scale relative to potentially more advanced second/late-movers in order to accumulate further power.

With this scope of ambition will come a stronger desire and better understanding of Adjacent Governance and activism, and likely with that, alliances, games, and wars that emerge over time.

Thank you to John Palmer and Kevin Kwok for reading earlier drafts of this.

Recent Comments