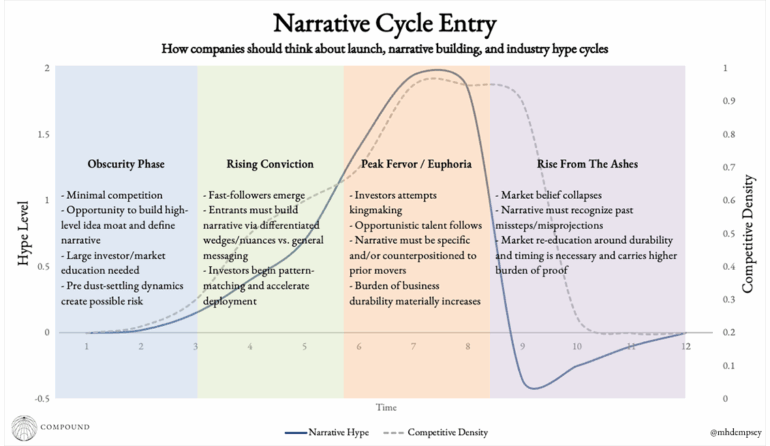

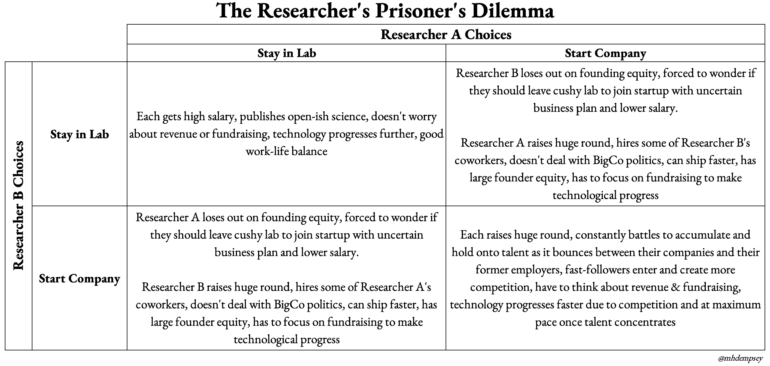

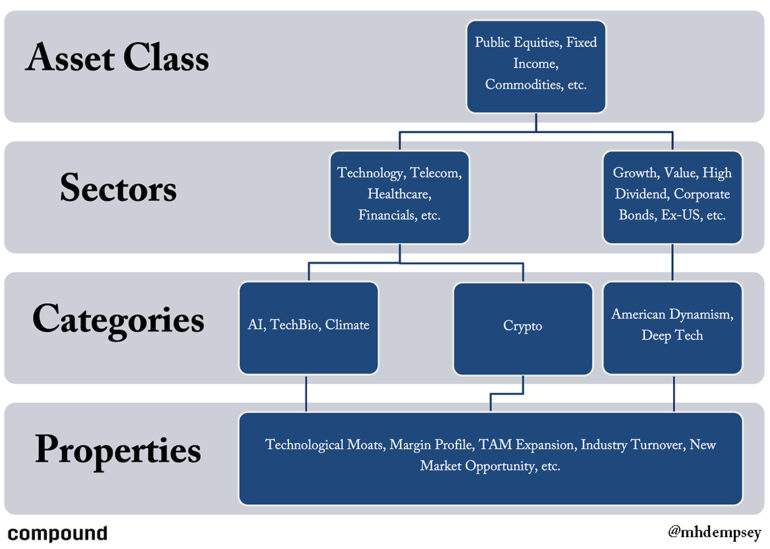

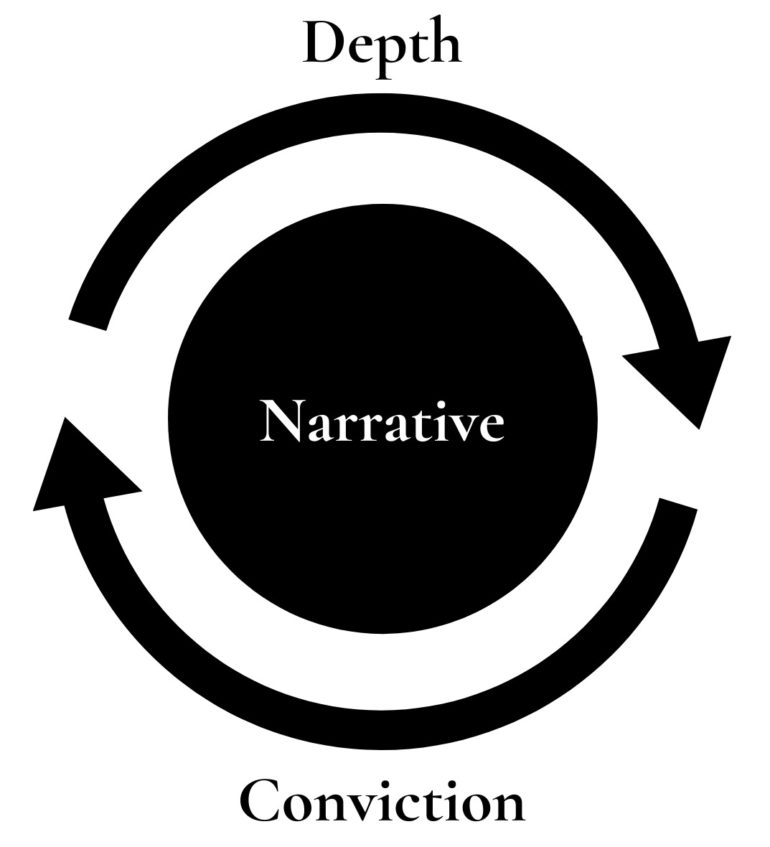

Now more than ever applied research1frontier tech? deep tech science? tech? companies must approach technology with a strategy and market positioning in order to survive the gauntlet of research, science, and engineering in order to bridge the R&D gap to commercialization and fundraising. In many companies, these strategies feel emergent, but at Compound we tend to believe they optimally...

Recent Comments