Nothing has become more clear in investing over the past few years than the idea that narratives play a major role in asset pricing. This has led to the emergence of a cottage industry surrounding tech narrative distillation including entire investment firms oriented around narrative building as their core value-add.

As companies rise in prominence, their narratives become more solidified. Doubters are silenced as investor dollars flow in (which people equate to success) and echo chambers ring louder and louder, reinforcing consensus with little room for doubt or nuance.

This market condition is when investing is least interesting to me and many just chase market beta, while the opposite is when perhaps there is the most alpha to capture. Specifically, markets are at their most interesting when narratives cycle, unable to stand the test of time, pulling companies and sectors from dead to interesting and investors from quiet to loud.

There is little value in repeating solidified narratives but there is immense value in understanding when narratives are about to change and forming conviction that lasts through multiple cycles.

Narrative Rotation

There’s a well-known market behavior within crypto that relates to narrative cycles. The idea being that capital hops around to different narratives, so even if there’s a finite amount of money in the system, people rotate in/out of narratives by buying and selling tokens. Cobie wrote in detail about this in his post Trading the metagame.

Crypto takes a lot of heat for this as the doubters believe this contributes to the idea that the only use-case of crypto is a casino. People (often rightfully) claim there isn’t much analysis done on the validity of the narratives, the depth of those peddling the narratives, or even the staying power of how long given investors support the narratives (all of these are aided by the pseudonymous culture of crypto). Instead the analysis is done on who can rotate fastest, front-running capital before the rise and dumping on latecomers before the narrative reaches market exhaustion or collapses as false.

Conviction and Narrative Cycle Speed

In times void of true conviction1Some people call these times lacking innovation, narratives cycle faster and faster.

If we look back at 2020/2021, there was high conviction in a variety of narratives within tech that led to historic levels of capital being raised and deployed. E-Comm scaling, enterprise cloud penetration, financial institution incumbent disruption, emerging markets like LATAM and the Middle East maturing, deep tech companies being appreciated for their 2025E revenue, and on and on it went.

Investors were frequently patting themselves on the back as it became easier and easier to believe these narratives because everyone around the tech ecosystem was repeating them.

This eventually changed.

Tech investor psychology has now been slowly bleeding out for 12+ months and a lot of people in this time period have frozen their investing with their conviction shattered and no new narratives able to break out past the cloudy macro picture and tech market reset.

But after a career of 12-24 month fund cycles, many of this generation’s investors struggle to not invest. As time went on and weeks turned to months of no new deals, restlessness settled in throughout late 2021 and 2022. This led to many investors grasping for narratives. These narratives may have started with things like American Dynamism2This was truly a masterclass in marketing and narrative building by A16Z or Climate and most recently has been a tidal wave of people muttering the words “Generative AI”.

Just like in crypto these days, where the market is suffering from a bubble burst and narratives are pumped and dumped in a single week, tech is doing the same, cycling faster and faster between each of these narrative points. Conversations everywhere are around what is or isn’t possible or who is or is not good, whipsawing back and forth on a near weekly basis amidst uncertainty, but all said with immense amounts of conviction.

Within these loosely-held but fast-to-become-hot narratives you begin to see mini-cycles occur, which shows the lack of depth behind the conviction3Or more graciously, rapid learning. In AI for example many VCs went from conviction around owning the “AGI” model layer to shifting towards the application layer as being what matters. Then they wondered about moat building for the application layer (“Does OpenAI just win everything?”) to deep conviction around only specific verticals like search, copywriting, or creative tools (“AI is the future of vertical software”).

“Usually, metagames start with a long-term investment thesis transitioning to popularity, and end in mimetic exuberance.”

Cobie

Eventually we’ll probably have another Infrastructure and DevTool renaissance in AI, just as we did in 2016-2018 when VCs couldn’t parse what applications mattered or worked at scale and thus leaned on the trusty old “pickaxes and shovels” framework.

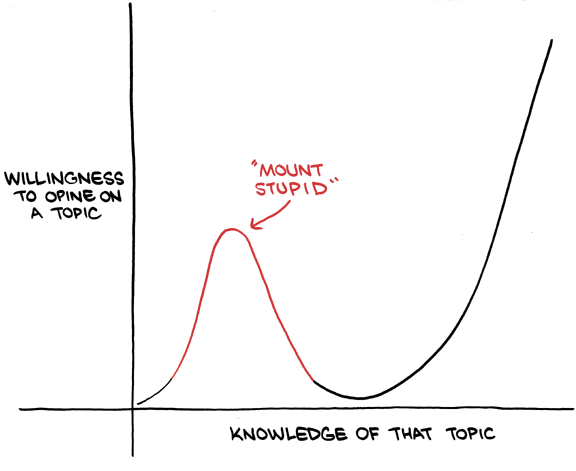

The volume of conviction from investors often front-runs the depth of conviction.

Parsing Narrative Cycles Effectively

Within this phenomenon are multiple takeaways for market participants.

First, regardless of where you sit in the ecosystem, monitoring the cycles of narratives is a great barometer for the depth of thought and conviction currently in the market.

High consensus repeatedly amongst narratives as they cycle means people are lacking depth of thought and thus grasping for ideas to hang their hat on either for themselves or their investors.

Rapid switching between narratives means that there is low conviction in any given part of the market, leading to people jumping at the newest and shiniest thing, instead of sitting with a concept for long enough to let doubt creep in and work the problems.

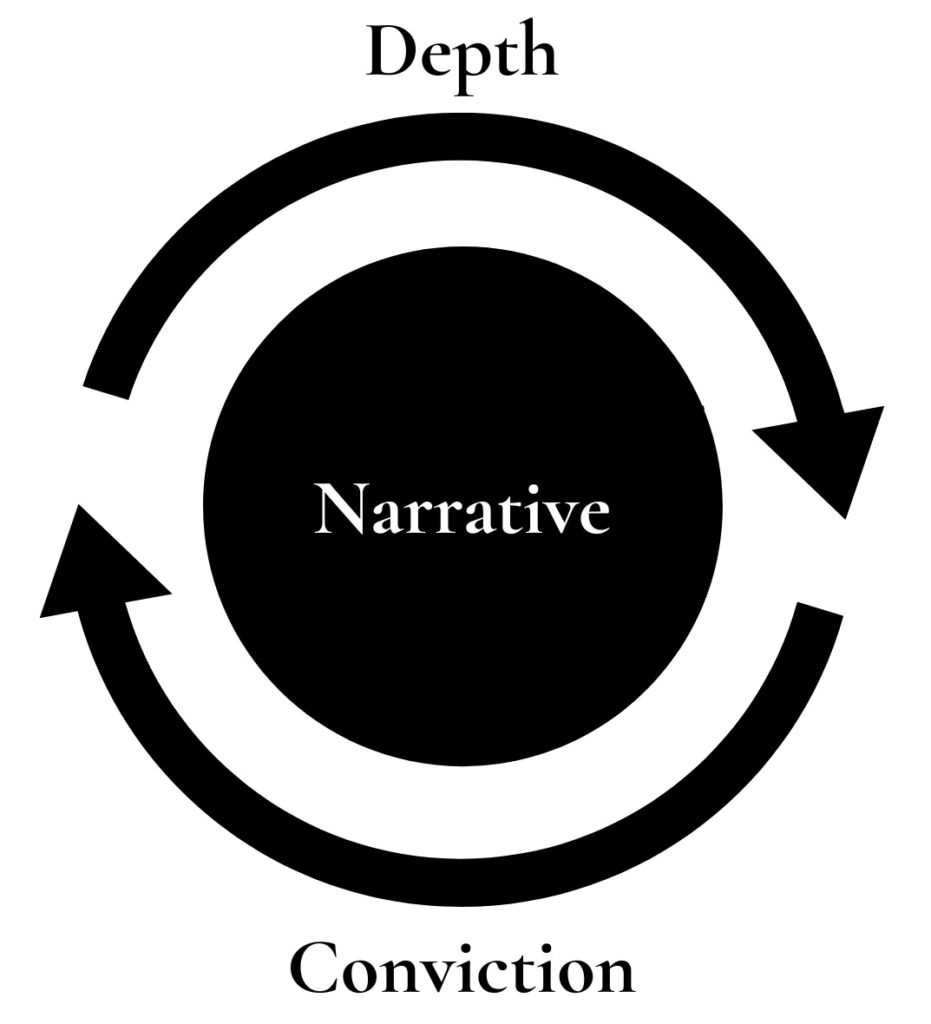

In an ideal world, you can view these two concepts of depth and conviction as a flywheel of sorts, building upon one another, however in reality it often instead looks something like Mount Stupid.

What’s most actionable for founders (and investors perhaps) is to make sure your conviction isn’t cycling with the echo chamber.

An exercise I suggest founders do when they are navigating the long-term idea maze in the early days of their company is to write down their monthly thoughts on a given pivotal decision (How much should we verticalize? What is right scaled GTM or customer profile? Pricing? Build vs. Buy? etc.). It allows them to have an unbiased view of their conviction and depth over time.4VCs should do this too with their theses if they are orienting their whole investing strategy or firm brand around something

With respect to VCs – Founders should push on how a VC’s conviction or thinking has evolved.5Searching old tweets is good for this, though many delete those as we bury the dead quietly here in startup land If it matches the twitter echo chamber, dig deeper as not all consensus views are wrong.

The last but perhaps most important thing to understand about narrative cycles is that intellectual honesty is core to survival. Narrative cycles are most prevalent in times of uncertainty, and you don’t want a partner (VC, founder, or other) who is falsely confident or intellectually dishonest during these times as they are bound to change.

Narrative Cycles as a sign of something larger

It is natural in times of uncertainty, volatility, and novel breakthroughs to experience discomfort and lack conviction, perhaps even get things wrong and learn from it. But analyzing this past year or two of narrative cycling within venture points to something larger happening.

At times I wonder if the trading mindset that we all talk about proliferating through retail has also infiltrated VC and startups broadly. Narrative cycles are faster and tighter than ever before, fueled by this idea of winning what is happening now, an extrapolation of the fast dopamine hits we all crave, perhaps more for social capital than financial capital. Few seem to have the patience to sit and watch these themes unfold over a decade, diligently tacking their proverbial ships left and right as storms send them somewhat off path.

Perhaps we got it right that everyone now wants to be an investor, but we got it wrong thinking that most should be venture capitalists.

Recent Comments