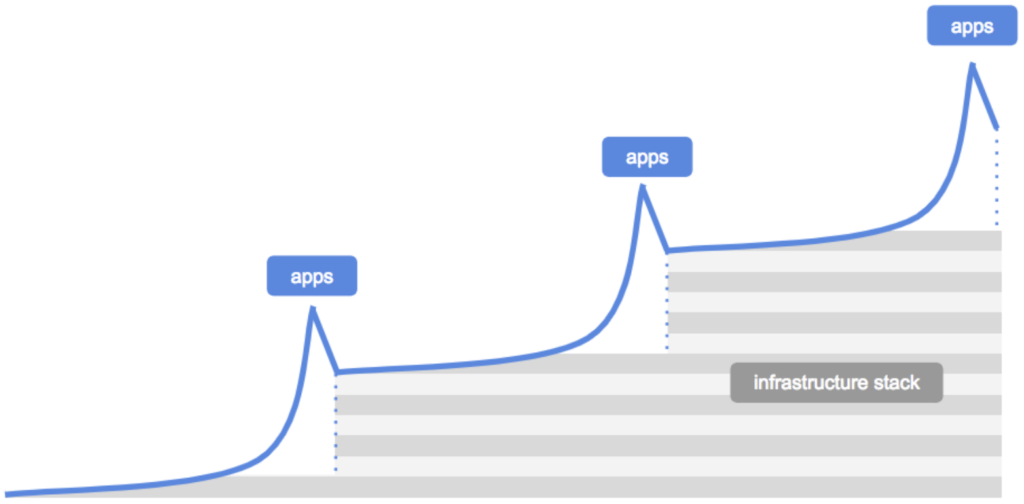

I recently re-read three fantastic (and imo canonical) older crypto posts that shaped a lot of how people think about value capture in crypto (Fat Protocols, Thin Applications, and Crypto Tokens and the Coming Age of Protocol Innovation).

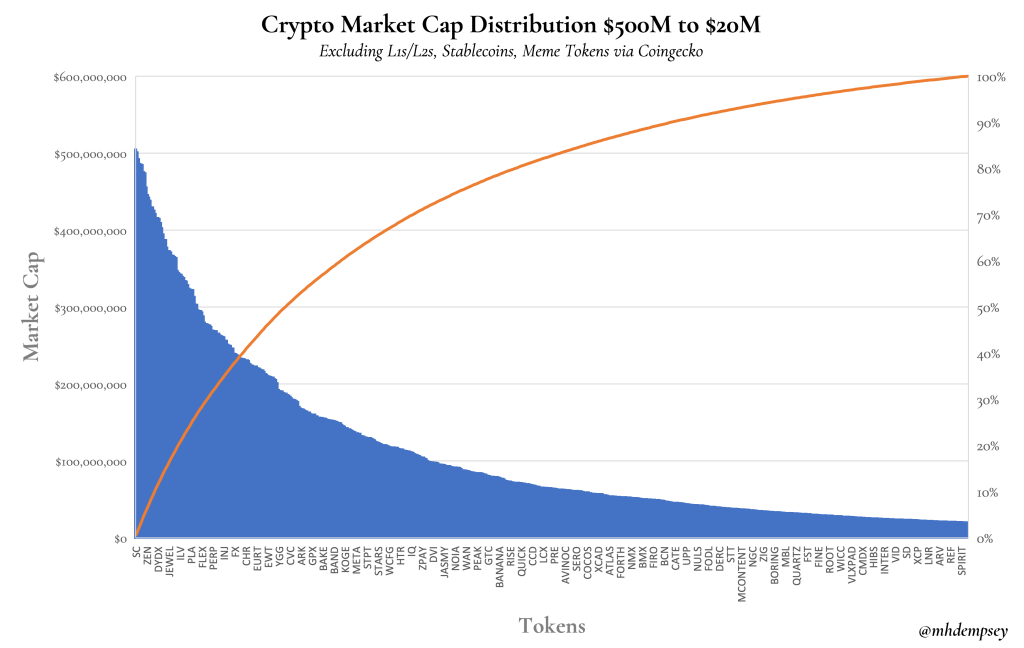

The original fat protocol thesis is well understood in terms of L1 value accrual, but it also meant that you saw a more long-tail dynamic within Dapps, which meant less of a power law from a % chance of success perspective (i.e. many tokens will be worth *something* while few go to 0, as I wrote about previously).

What we see in bull markets (and perhaps crypto in general) is a shift of how people look at Expected Value.

This leads us to a logical conclusion today where the majority of builders view the maximum EV thing to do is build new L1s or L2s instead of Dapps or application-centric protocols, leading to a world of further fragmentation and plentiful useless blockspace. They then take a step down and build abstractions to siphon off some the L1/L2 value in things like LSTs.

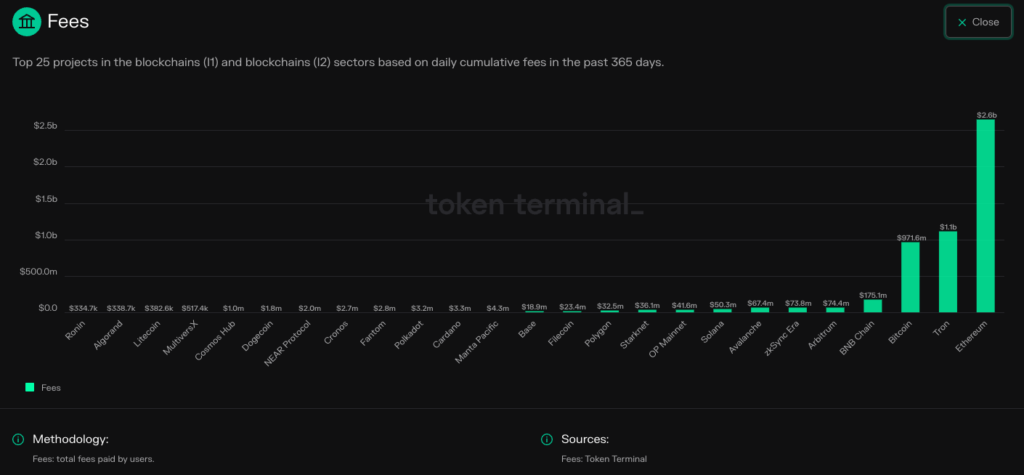

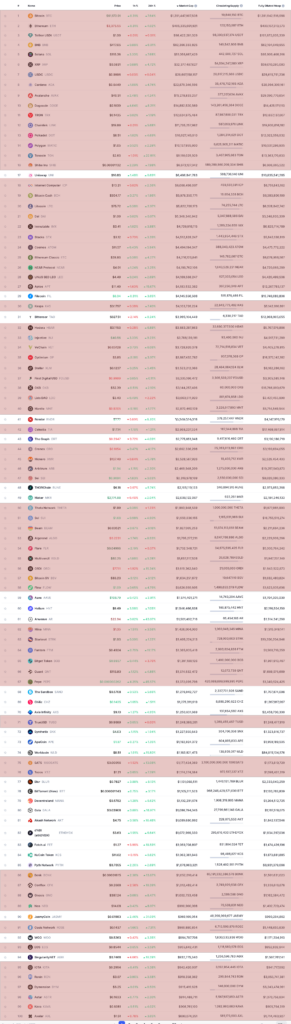

Some may make the argument that this dynamic is because of the fee structures and “defensibility” of blockspace relative to Dapps in crypto. As shown in the data above, L1s and L2s make up the majority of cumulative economic value capture in crypto today. This, along with deeper analyses of the business models of blockspace, explains the massive FDVs for a variety of L1s like Ethereum (and more actually to this point, things like insert zombie L1 here)1I’m not naming names because I want all the readers who love cardano etc. to think I’m definitely not talking about their useless L1 and to a lesser extent dominant L2s like Arbitrum2Disclosure: Compound invested in the seed round of Offchain Labs, and also plays into the terminal network premium that crypto protocols get where speculators are willing to model network scale and penetration many years into the future and pay for that today, resulting in high multiples.

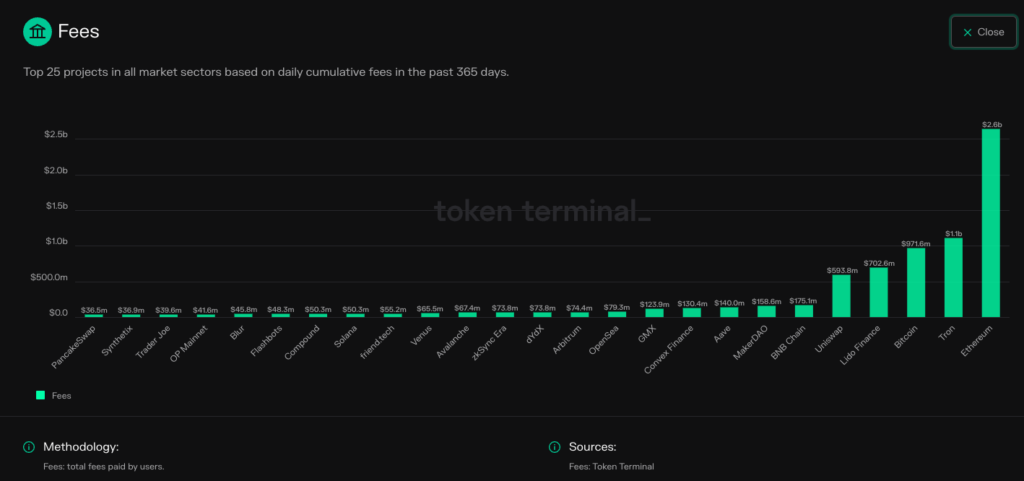

That said, this is somewhat disproven in utility when you look at the trailing 365 day fees across all protocols on Token Terminal, with a variety of DeFi Protocols outpacing far higher-valued blockspace.

Of course, fees in 2024 are not a perfect measure as there are many other determinants to value including defensibility, terminal scalability, net profitability of a protocol, and even theoretically the token’s ability to capture this stream of capital.

We saw the latter recently get its first test with the proposal to turn on UNI fee accrual and a wave of other DeFi protocols trading up quickly in concert with this as markets re-rated the likelihood of “valueless governance tokens” capturing tangible value.

So yes, blockspace is a good business (and perhaps a clean business with lower regulatory barriers), but if we peel back the veil of ignorance, the reality is, there is a flywheel, or perhaps a vicious cycle of perverse incentives between founders and investors today that lead to the everlasting creation of blockspace.

The Large Fund Phenomenon

Investors raise larger funds with the need to deploy larger sums of capital in search of increasingly large returns. This strategy is easiest to run via investing in capital-intensive projects3In traditional venture we are seeing this now today as well with large sovereign wealth funds and venture funds deploying capital into companies with similar capital intensity. All of that capital needs to find returns that can justify billions of dollars of FDV being created and getting liquid.

We can look at the top 100 tokens by market cap and see the red representing tokens that fall within this framework. As one can see, there are very few protocols that are worth billions of dollars that aren’t effectively new types of block space, or siphoning off infrastructural value. The story doesn’t get much better if you use FDV instead of market cap.

For someone like me (and our firm Compound) who wants to see the long-term promises of crypto matter in the world, I believe this cycle of VC and Founder blockspace inflation will erode the ecosystem (some could argue it already has) and likely lead to even louder monolithic vs. modular chain -esque debates that don’t actually matter, and result in little progress.

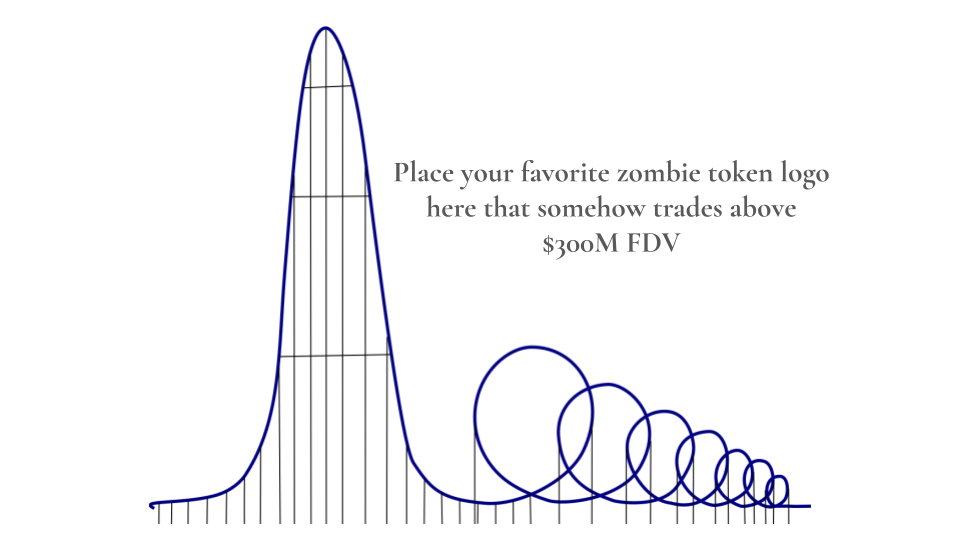

We’ll get new blockspace each cycle, with some value erosion happening for underutilized L1s and L2s, and maybe every now and then new value capture that looks a lot like an L1 narrative (Data availability, Restaking, etc.) will insert itself into a slightly smaller flywheel before a wave of copycats and the nth version of these protocols descending down the Euthanasia Coaster of Impossible to Fathom Billion Dollar FDV tokens.

And the best part is, these tokens will still probably be more highly valued than real applications with real usage and real utility.

This dynamic that exists is net negative for crypto for two reasons:

1) It discourages novel experiments due to the capital markets preferring existing playbooks and the risk/return being skewed to the downside.

2) It only marginally improves crypto adoption.

Once upon a time there were many infrastructure level areas that needed to be innovated on. We needed more blockspace, faster VMs, better fiat to crypto rails, better wallet onboarding, etc. in order to enable new use-cases. Now we are at a state where we are no longer technologically constrained.

You can build basically anything you want on-chain for early adopter types (of which there are many) and will soon be at a point where the tooling exists for early majority/majority type users in most parts of the world.

Evolving Expected Value

If we take a step back and navigate how we can change how people think about expected value in crypto, we can materially change the trajectory of crypto instead of just marginally progressing the industry.

There are ~3 clear and logical paths for these next steps, ideally leading to a more diversified way to capture value and build meaningful protocols and Dapps.

1) An effective duopoly/oligopoly of the Base-chain

Mobile went through similar paradigms as crypto is now, as smartphones transitioned and every OEM had their own OS and app ecosystem. Blackberry, PalmOS, Windows Phone, Android, iOS, and a slew of others all meant that there was fragmentation in a desire to own the phone + OS combo. Eventually it played itself out with two dominant ecosystems emerging of iOS and Android.

Many have made these comparisons as perhaps Solana and Ethereum (as Android has various forks of its software, with value accruing to the Google Play store in a similar way the EVM could work and value could accrue to the settlement layer of ETH from L2s/L3s etc.).

This would lead to the +EV thing to do being developing Dapps that dominate either side of the Duopoly (or both), along with the fragmentation solvers such as Restaking or things like Arbitrum Research’s Chain-Clusters being value capturing.

This is the best possible outcome to drive long-term value to crypto as it will structurally force innovation onto the application layer and create a flywheel to enable total crypto market cap growth via Dapps and L1s moving up in concert with one another.

2) A fragmented decentralized/centralized/app-chain future that Cosmos people probably love for the app-chain thesis and centralized players love as they remove the trustlessness (what’s up JPMChain).

This is a frankenstein model of the spectrum of decentralization where value capture is perhaps siphoned by players that orchestrate the fragmentation of a variety of “Blockchains”, perhaps analogous to AWS, Azure, and GCP extracting (and also enabling) major value from the growth of applications in traditional software as well as more novel AI software.

Solana Token Extensions4The February 2024 letter by Joe McCann is fantastic on this are another interesting framework to have in this world and could once again create a stepping stone where we see a “centralization → decentralization” dynamic occur in crypto over many cycles in a similar way that we see “bundling → unbundling” cycles occur in software.

3) We just keep launching new tokens with high FDVs with new narratives of blockspace because speculation and money.

This future sucks and I will waste no more words discussing it, but it is a very real one. I’d recommend reading the perhaps a bit roundabout nihilism take here.

What Needs To Happen?

In order to push towards these desired futures that many who actually believe in crypto want, a few core things need to change:

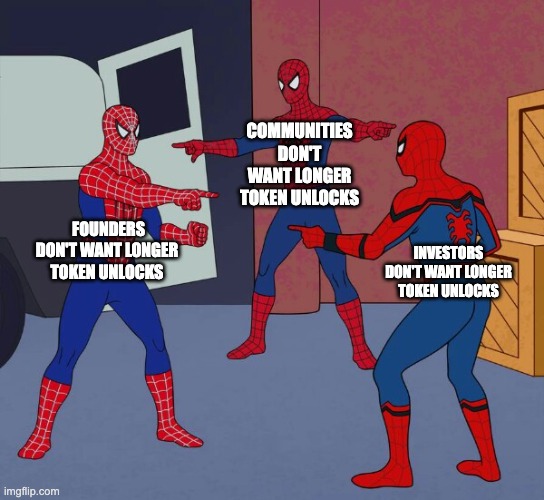

1) We must create longer-term and more sophisticated token lock ups.

There is a perpetual nodding of the head that comes with this statement whether you are talking to founders or investors…and then very little changes. This begs the second question:

Who is responsible for doing this if we all claim we want it?

Investors say they can’t push for longer lockups because they will lose deals to other firms who are fine with shorter ones. Founders say investors push for the shorter lock ups as well, and talent may be hard to keep with a longer lock up.

There is a world where this could be pushed collectively by the larger funds/the LPs of those funds. There is also the possibility that a subset of founders could push for this as a statement in a world in which your given project can be forked alongside a fast-vest token.

The dark horse and most likely candidate of this all is the community and broader ecosystem could force changes. We sort of saw this recently with the effective bullying of the Starkware team into changing their team and investor unlock schedule.

In a longer-term and more sophisticated token unlock world, if you launch useless blockspace, retail and the community broadly has multiple years to dump their tokens on you and use the market as a weighing machine before investors and teams are able to capture value. This will discourage the 100th L1.

In addition this will require dapps to think about longer-term product development cycles and value capture instead of shooting star products that aren’t sustainable or long-term value additive but still enable groups to extract capital from the ecosystem and enrich teams and investors.

In all scenarios, you can tie the unlocks to time + (less gameable) milestones in order to somewhat combat the clear structural disadvantage one could argue you are at versus other teams with faster token unlocks.

2) We need a few breakout non-infra protocols.

Aave/Compound/Maker/Uniswap and others invigorated a generation of builders to move into DeFi due to the value that they created from a token perspective and in pushing forward a new use-case for smart contracts. This created an ecosystem of DeFi builders that should compound over multiple cycles.

It will likely take other large scale wins like Helium, RNDR, Livepeer, or more to continue to scale past $10B+ FDV (and to outperform zombie L1s) in order to change the tide to make the expected value of building within DePIN or other categories seem worth it. I’m confident in this area, as well as many others, that price will drive activity, moving from category to category with winners paving the way in each and inspiring new ambitious shots on goal.

3) I find myself at times coming back to Hyperstructures as a concept.

While I think those are overly idealistic when thinking about Eth and Solana or whatever other oligopoly emerges within crypto, the idea that value from dapps can be net accretive without too many unnecessary drags on “margin” is interesting.

Put another way, if we can simplify the infrastructure and middleware, as we like to do when we make the arguments for smart contracts in general, we can imagine a world where the incentives of all builders in crypto sits within Dapps that can bring real use-cases and scaled users and the choice isn’t what L1/L2 should this be built on but instead what tokens do users want to own to continually capture value created by that protocol.

Insanity or Change

It is possible that the current fragmentation and over-extension of blockspace is just the natural result of an early ecosystem figuring out what does and doesn’t make sense and that the early financialization of crypto results in a greater slope of difficulty to look past short-term optimizations . It’s possible that we will ultimately find the few dominant L1s and L2s and the past decade of token value structures will be a distinct memory of the “early days” of crypto.

Either way it’s clear to me that the optimal path for crypto as we enter a new cycle of capital flows, user adoption, and numbers going up is where the expected value balances a bit more towards applications and a bit away from infrastructure. In fact, it is existential.

The end result in this likely looks similar to a far more virtuous cycle of infrastructure and application development, akin to the cycle described in The Myth of The Infrastructure Phase.

Ultimately, we get what we ask for in crypto.

If L1s and L2s and restaking protocols, and more, keep accumulating the vast majority of resources, then we will be constantly seeking applications, use-cases, and futures that will never come.

With this potential outcome I am reminded of the famous quote:

“The definition of insanity is doing the same thing over and over again and expecting different results.”

Recent Comments