On Monday I sent the above tweet. Some people pushed back on this being a predatory view, and VCs seizing a moment in order to push their own agenda and incentives. This is a fair push but a misguided one IMO. So let me try to explain why pricing has been impacted in venture capital.

I’ll walk through those dynamics in some semblance of an order of how they trickle down.

VC-backed companies trade growth for profitability

VC-backed companies are often reliant on continually raising money in order to invest in growth and R&D in an outsized manner, relative to reinvestment of profits. Some can become profitable and still maintain growth, and maybe in a more risk-off environment we’ll see a return to that post-series B, but I’d imagine this dynamic won’t materially change before that.

Most funds rely on other funds to continue to fuel that growth

Some funds are able to finance these companies throughout their entire lifecycle when there is very strong product-market fit due to strong demand1Most famously, Sequoia did this with Whatsapp. Others (like Compound) rely on other VCs to gain materially larger conviction in their portfolio companies in 12-24 month inflection points. As much as I love the idea of being contrarian and right, I actually have to believe that what we know about the market that others don’t, will become more of a widely believed truth over time.

LPs pull back from venture. Liquidity looks worse. Fund sizes decrease. Concentration decreases as paper gains evaporate.

In a world where large institutional LPs are seeing their exposure to venture increase and exposure to public markets decrease, due to the market falling 30% (read more about this here or search denominator effect), there is a world where we see material pullback in venture fund financing. These LPs also were expecting some material liquidity in 2020 and perhaps 2021, which likely won’t be happening now (or have been crushed in public markets). This creates a trickle down effect to larger funds potentially closing, or maybe more likely, sizing down funds as commitments slow. Funds that have to size down their fund size (and the LPs in these funds), may not want to be as concentrated in portfolio companies after seeing how quickly paper valuations can implode (see Lime, AirBnB, and more) for the next few years. This creates a similar dynamic to the one that Compound has to deal with as a $50M fund, for funds that size down from $500M to $250M.

Demand shock could lower M&A and economic pullback will lower exit valuation multiples

Many sectors are experiencing a demand shock. We do not know how long this demand shock will last or what the cascading effects within our economy will be. Because of this, when we’re thinking about outcomes it becomes a lot more difficult to envision large scale M&A (due to companies potentially hoarding cash)2Also, we can think about the FAANG type companies could soon be in a world where they globally are more heavily taxed, reducing their cash positions, as the entire world economy tries to recover from massive financial stimulus. as well as valuation multiples3I enjoyed this post by Tomasz Tunguz on software valuation multiples post-COVID being as high as they previously were (again, limiting IPO market caps).

Fund returning outcomes are fewer and farther between at yesterday’s prices

VCs are in the business of $1B+ outcomes. This dynamic changes with fund size and ownership. I’ve written extensively about this. If previously VCs believed that the number of $1B+ outcomes were increasing due to public markets rewarding high growth for the sake of poor/unproven economics, and large public companies being able to play offense with M&A due to large cash positions as well as soaring stock prices, then we believe in a higher upper bound and thus greater expected value for companies yesterday versus today. In this new world one could now believe that expected value will be lower, due to a lower number of $1B+ outcomes, or the magnitude at which companies will exit for being lower. 4There’s an argument here to be made that with smaller funds will come lower Return The Fund numbers, but prices have to come down with those fund sizes as well to some degree)

Aggregate VC-backed exit values could fall

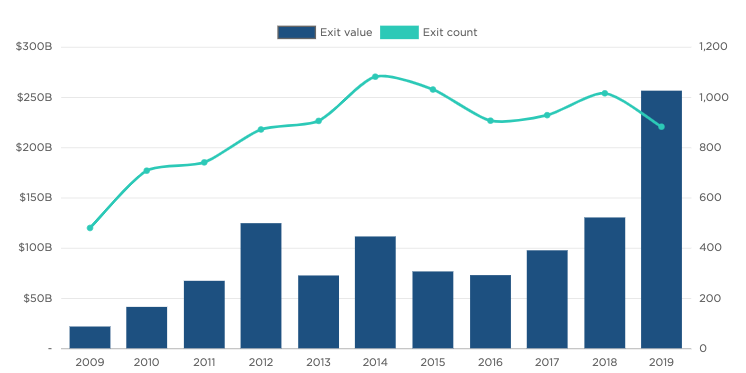

Related to that, let’s look at exit values.

As VCs it is our job to be optimistic about the future and specifically disruption. But if before we could underwrite total exit values to venture-backed companiees to levels like the chart above shows (two straight years of record values) then perhaps we are looking at a world where those value levels fall, and with that, it only makes rational sense the pricing does as well. While pricing drastically increased despite value creation remaining fairly level 2011-2016, this was largely driven by supply of more capital, as well as technological shifts that unlocked new, massive opportunities for disruption (mobile + cloud compute).

Markets are digesting all of this in real-time

So what’s happening now?

Across both VC, founders, and public market investors, all can look at the above chart on exit values and disagree about how much value creation we see in the future. In addition, the messaging of VCs to founders in the market is different than from VC to VC due to reputation. But unlike 2011-2016, we don’t necessarily have a consensus view on what technological shifts or factors will drive a new outsized level of disruption5Some could argue machine learning or various areas of bio. Others will argue that mobile was the last platform shift. Either way, we’ve seen feverish demand for people trying to figure out what the next platform is, and failing for years (VR, Blockchain), especially not as incumbents have become incredibly good at innovating and disrupting themselves.

As I wrote in our COVID-19 update, VCs are saying they are open for business (though this has calmed down), but in reality, I don’t see that being the case and expect a massive drop off in funding activity for March and beyond. VCs are also no longer agreeing on what pricing should be, leaving founders in an outsized state of flux in terms of what is “fair” pricing vs. not. Pair this with some founders recognizing this shift at different levels with others, and also some VCs not wanting to seemingly disrespect founders by offering too low of a price, and you have a really messy, and largely frozen, market.

Founders and VCs aren’t coalescing around a single range of prices for various levels of traction or even stage, because for some spaces and some firms, there is no range of prices that will get a deal done, and for others there are tons6Part of my job over the past few weeks has been getting a proper read, almost fund by fund, on how people are viewing the market, for our portfolio companies that will raise in 2020. We’re seeing this divide at Seed where I’d argue prices have fallen 10-20%, and even moreso at A7Which already had such a range of prices. We’ve seen series As priced anywhere from $25M to $125M+ in the past 2 years. where I’d argue valuations have fallen 30-40% (though I haven’t seen a material number of Series As that have started and closed a process post-COVID).

Layer on top of that, that many founders aren’t also pursuing a different pitch and we have a true recipe for difficulty. Founders must be able to pitch how their business will fit within a post-COVID world. Why are you ok being remote for the next 6 months? Why is lack of customer demand for possibly 12 months not existential? How do you fit within the fundraising dynamic for a series A/B/C after all of this? If this lasts longer than we think, how does that work with your 18-24 month runway? And if you’re revising your pitch, why should I believe your revisions vs. a month ago?

Summary

So all of these data points can be summarized as:

- We don’t know how bad COVID-19 will shock our national and global economy, and we all have varying views with honestly low confidence levels on those views.

- The future perceived (or real) exit value of VC-backed companies could be lower than at the latest peak in 2019, changing expected value for startups broadly.8This is especially frustrating to hear to founders raising seed capital today, when their expected exit window is 7-10 years from now.

- We don’t have consensus on what drives the next wave of disruption and innovation, so we don’t have a strong bull case narrative.

- Founders and VCs aren’t able to coalesce around a single range of prices for different levels of traction or stage.

You could argue that this all can be summarized as a market supply and demand imbalance, where there are a lot of companies now hitting the market trying to bridge or raise themselves past a possible recession, and a ton of VCs that are sitting on their hands waiting to see how bad things could get. The issue is VCs and founders are potentially so far apart that they might not be even showing up to the same market to discuss trading. And thus, markets aren’t clearing.

Appendix

A few things to note:

1. We must think about these as “fundable startups” and not just “all startups”. Pricing does not allow companies to cross that chasm in most cases, IMO. The chasm that pricing does change though is the view on necessary expected value.

2. Venture capital is a no called strike business, Warren Buffett famously said this about stock market investing.

“In the securities business, you literally every day have thousands of the major American corporations offered to you at a price and at a price that changes daily. And you don’t have to make any decisions. Nothing is forced upon you. There are no called strikes in the business,” Buffett said.

“They may be wonderful pitches to swing at, but if you don’t know enough, you don’t have to swing. And you can sit there and watch thousands of pitches and finally you get one right there where you want it … and then you swing,” he continued.

In some ways I agree with this for VC as well. While many funds can’t afford at their current sizes to miss on the massive companies, in some regards, many just need to be in 1 of 25 companies each year that matter.

Recent Comments